Bob Diamond's life is a high-stakes drama, a rollercoaster ride of ambition, risk, and spectacular reversals of fortune. His journey from relatively modest beginnings to amassing a vast fortune, only to see it dramatically threatened by scandal, is a compelling case study in the intoxicating allure and perilous pitfalls of the high-finance world. This is the story of a man who reshaped global banking, only to be reshaped himself by the consequences of his actions and the actions of those around him. For more on high net worth strategies, see this resource.

The Architect of Barclays' Rise

Diamond's early career was a testament to relentless drive and sharp intellect. He honed his skills in the cutthroat world of fixed-income trading at firms like Morgan Stanley and CS First Boston, developing a reputation not only for brilliance but for an almost reckless appetite for risk. This combination, a potent mix of strategic vision and audacious gambles, would define his future successes and ultimately contribute to his dramatic downfall. He accumulated significant wealth during this period, laying the foundation for the even greater fortunes he would soon acquire.

How much was he worth before Barclays? Precise figures remain elusive, but his early success clearly built a substantial base upon which his later fortunes were constructed. His rise at Barclays amplified this wealth exponentially.

Barclays and the Libor Scandal: A Turning Point

Diamond's tenure at Barclays marked a transformative period, not only for the bank but for his own net worth. He arrived and, through aggressive acquisitions and bold strategic maneuvers, transformed Barclays Capital from a relative lightweight into a global powerhouse. His aggressive growth strategy, fueled by an almost unquenchable thirst for risk, yielded extraordinary returns. His net worth soared, mirroring Barclays' meteoric ascent. He became one of the most influential figures in global finance, his name synonymous with power and success.

However, this period of unparalleled success is inextricably linked to the infamous Libor scandal. The manipulation of the London Interbank Offered Rate (LIBOR), a benchmark interest rate underpinning trillions of dollars in financial transactions, implicated Barclays, and Diamond's role remains intensely debated. Did he orchestrate the manipulation? Was he complicit through negligence? Or was he a victim of a toxic culture he failed to adequately control? The truth, likely a complex blend of factors, remains shrouded in the fog of legal battles and conflicting accounts. Whatever the precise level of his involvement, the scandal irrevocably damaged his reputation and severely impacted his net worth. His resignation was abrupt and dramatic, a stark contrast to the years of seemingly unstoppable growth that preceded it. While the precise impact on his personal wealth remains undisclosed, the damage was undoubtedly significant.

What percentage of his net worth was wiped out during that period? That is impossible to answer definitively with currently available information.

Resilience and Reinvention: A Second Act in Africa

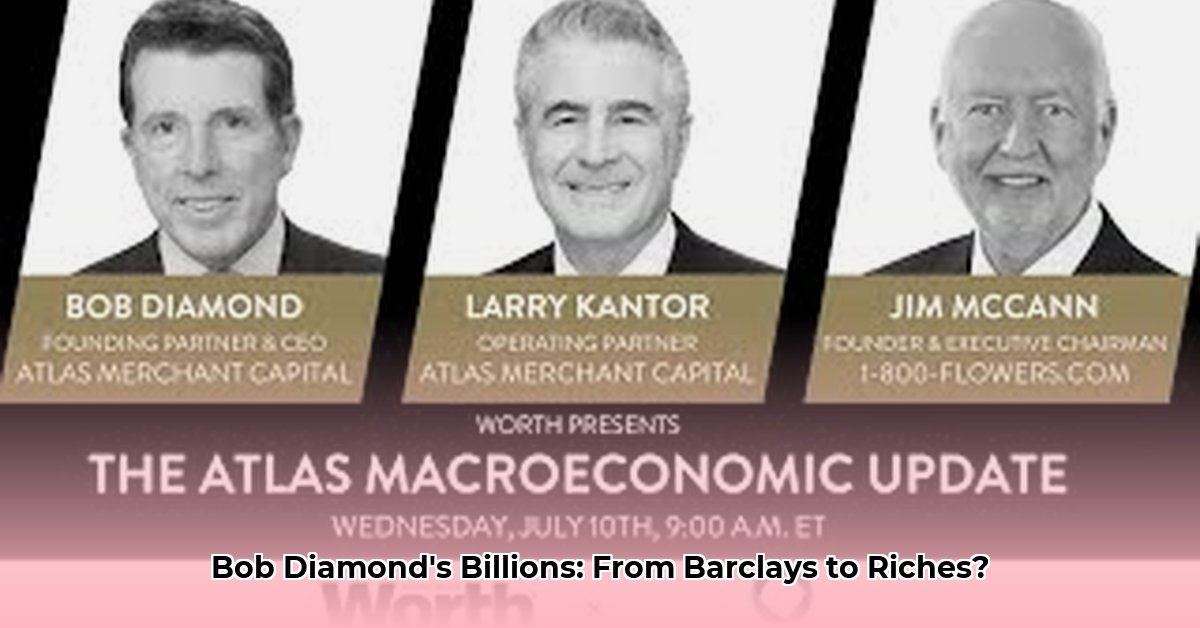

The Libor scandal could have easily marked the end of Diamond's career. Instead, it became the catalyst for a remarkable second act. Rather than retreat, Diamond leveraged his extensive network and expertise to launch entrepreneurial ventures, primarily focusing on Africa. This unexpected shift displayed resilience and adaptability, showcasing his enduring entrepreneurial spirit and strategic acumen.

While his post-Barclays ventures might not have generated the astronomical returns of his Barclays era, they demonstrate a remarkable capacity to redefine himself and continue building wealth. His current net worth, while a shadow of its peak, remains substantial, a testament to his enduring drive and financial expertise. The exact figure, of course, remains private, but it is clear he has rebuilt a significant portion of his fortune. What percentage of his pre-scandal net worth has he recovered? Only time, and perhaps future disclosures, will reveal the answer.

A Complex Legacy: Risk, Reward, and Responsibility

Bob Diamond's story is a tapestry woven from ambition, risk, and consequence. It serves as a potent reminder of the precarious balance between immense success and devastating failure in the world of high finance. It is a cautionary tale, highlighting the potential repercussions of unchecked ambition and the critical importance of ethical conduct in a sector that profoundly impacts the global economy. His legacy remains complex and continues to fuel debates around regulatory oversight, corporate responsibility, and the enduring ethical challenges of the financial industry. His net worth, a fluctuating quantity reflecting this complex legacy, serves as a poignant symbol of his journey.

Simplified Financial Timeline (Approximate)

| Period | Key Events | Net Worth Impact |

|---|---|---|

| Early Career | Success in fixed-income trading | Significant Accumulation |

| Barclays Rise (2000s-2012) | CEO, Barclays transformation, Libor scandal | Massive increase, then substantial decrease |

| Post-Barclays (2012-Present) | African ventures and entrepreneurial activities | Gradual rebuilding and continued growth potential |

Note: Precise net worth figures are not publicly available.